Introduction to XM

XM is a leading global broker specializing in forex and CFD (Contracts for Difference) trading, established in 2009. With over 3.5 million clients across more than 190 countries, XM stands out for its transparency, fairness, and excellent customer service. Regulated by major financial authorities such as CySEC (Cyprus Securities and Exchange Commission) and ASIC (Australian Securities and Investments Commission), XM offers a secure and trustworthy environment for traders.

XM provides a wide range of trading products, including forex, commodities, stocks, indices, metals, and cryptocurrencies. The platform supports the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), enabling traders to access advanced tools and features for seamless market participation.

Why Register an Account with XM?

Choosing a reputable broker is a critical first step for any trader. XM not only offers safety and transparency but also provides numerous advantages:

- Flexible leverage: Up to 1:888, allowing traders to maximize returns with minimal capital.

- Multiple account types: Tailored to various trader needs, including Micro, Standard, and XM Ultra Low accounts with competitive spreads.

- Attractive bonuses: New users can benefit from promotions such as no-deposit bonuses to start trading without initial investment.

- Multilingual support: XM offers customer service in multiple languages, including Vietnamese, making the platform accessible to a global audience.

Step-by-Step Guide to Creating an XM Account

How to Open a Real Account

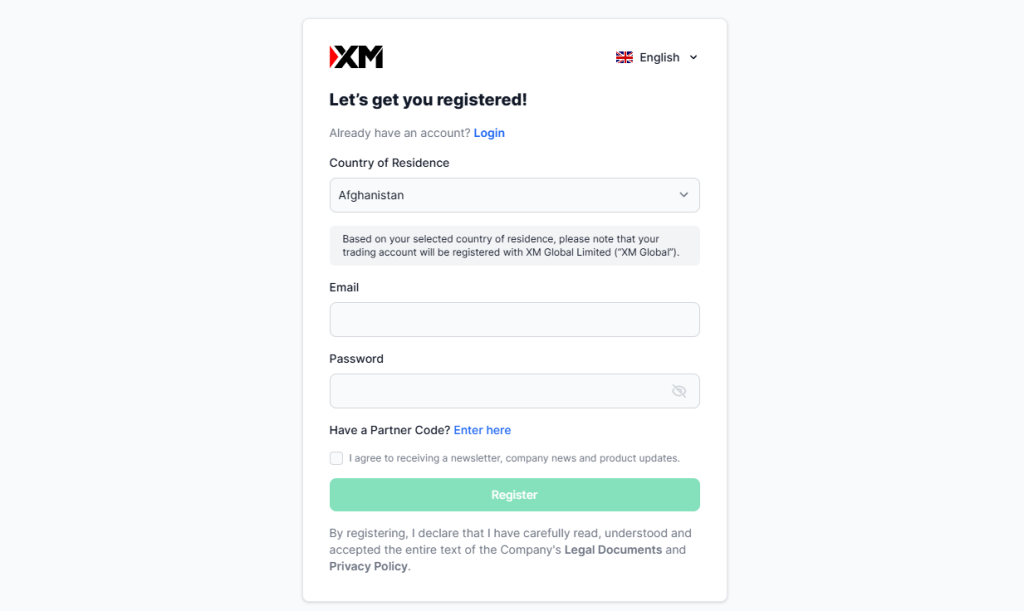

- Visit the XM official website: Go to https://www.xm.com.

- Choose your account type: XM offers three primary account types—Micro, Standard, and XM Ultra Low. Select the one that suits your trading goals.

- Fill in your personal information: Provide details such as your name, email address, country of residence, and phone number. Click “Proceed” once the form is complete.

- Complete registration details: Submit additional information about your financial status and trading experience to help XM tailor its services to your profile.

- Verify your identity: Upload documents to verify your identity (e.g., passport, national ID) and address (e.g., utility bill, bank statement).

- Activate your account: Once your documents are approved, you’ll receive a confirmation email. You can then fund your account and start trading.

How to Open a Demo Account

If you’re new to trading, XM’s demo account is a risk-free way to explore the platform. The process is similar to opening a real account:

- Visit XM’s demo account registration page.

- Enter basic personal details and choose a demo account type (MT4 or MT5).

- Set your virtual deposit amount and leverage.

- Complete registration and check your email for login credentials.

How to Claim XM Bonuses

XM frequently offers no-deposit bonuses for new accounts. Follow these steps to claim your bonus:

- Log in to your XM account.

- Navigate to the “Promotions” section.

- Opt into the bonus program and the funds will be credited to your trading account.

Verifying Your XM Account

To comply with international financial regulations, XM requires account verification before withdrawals or participation in promotions. Here’s what to do:

- Upload proof of identity: This can be a passport, national ID, or driver’s license.

- Provide proof of address: Submit a recent utility bill or bank statement showing your address (dated within the last three months).

- Verification timeline: The process typically takes 1–3 business days.

Overview of XM Account Types

XM caters to traders of all levels with three main account types:

- Micro Account: Ideal for beginners, with small trade sizes (1 lot = 1,000 currency units).

- Standard Account: Designed for experienced traders, offering larger trade sizes (1 lot = 100,000 currency units).

- XM Ultra Low Account: Features the lowest spreads and competitive trading conditions.

Key Differences Between Micro and Standard Accounts:

- Micro Account: Suitable for beginners with smaller trade volumes and lower risk.

- Standard Account: Targets seasoned traders seeking higher profit potential but with increased risk.

Additional Notes on XM Fees and Policies

XM does not charge deposit or withdrawal fees, making transactions more convenient for traders. However, traders should consider potential trading fees, such as spreads and swaps (overnight fees). The platform also offers negative balance protection, ensuring traders never lose more than their deposited funds.

Conclusion

Registering an XM account is straightforward and ensures a secure trading environment for beginners and experienced traders alike. With flexible leverage, attractive bonuses, and robust customer support, XM is an excellent choice for those looking to enter the world of online trading. Follow this guide to create your account and take advantage of XM’s features today!